A real-life email with some of our best SaaS resources and recommendations.

While we generally don’t work with self-funded startups, many of the resources we rely upon for early stage SaaS are relevant to firms that are just getting going. In fact, some of them are immensely helpful to the startup CEO who is isn’t yet a SaaS business model expert but whose business has morphed into a software company.

The situation my friend Mark Kaplan finds himself in is not uncommon: They’ve built a minimum viable product (MVP) and are starting to generate subscribers. Its revenues from the new business are small but beginning to show promise; in addition to clients from a successful parent company, they’ve got a small number of paying customers with whom there was no prior relationship. And this all is happening during the height of the pandemic, so this traction is encouraging in that new commitments are being made during the worst of times.

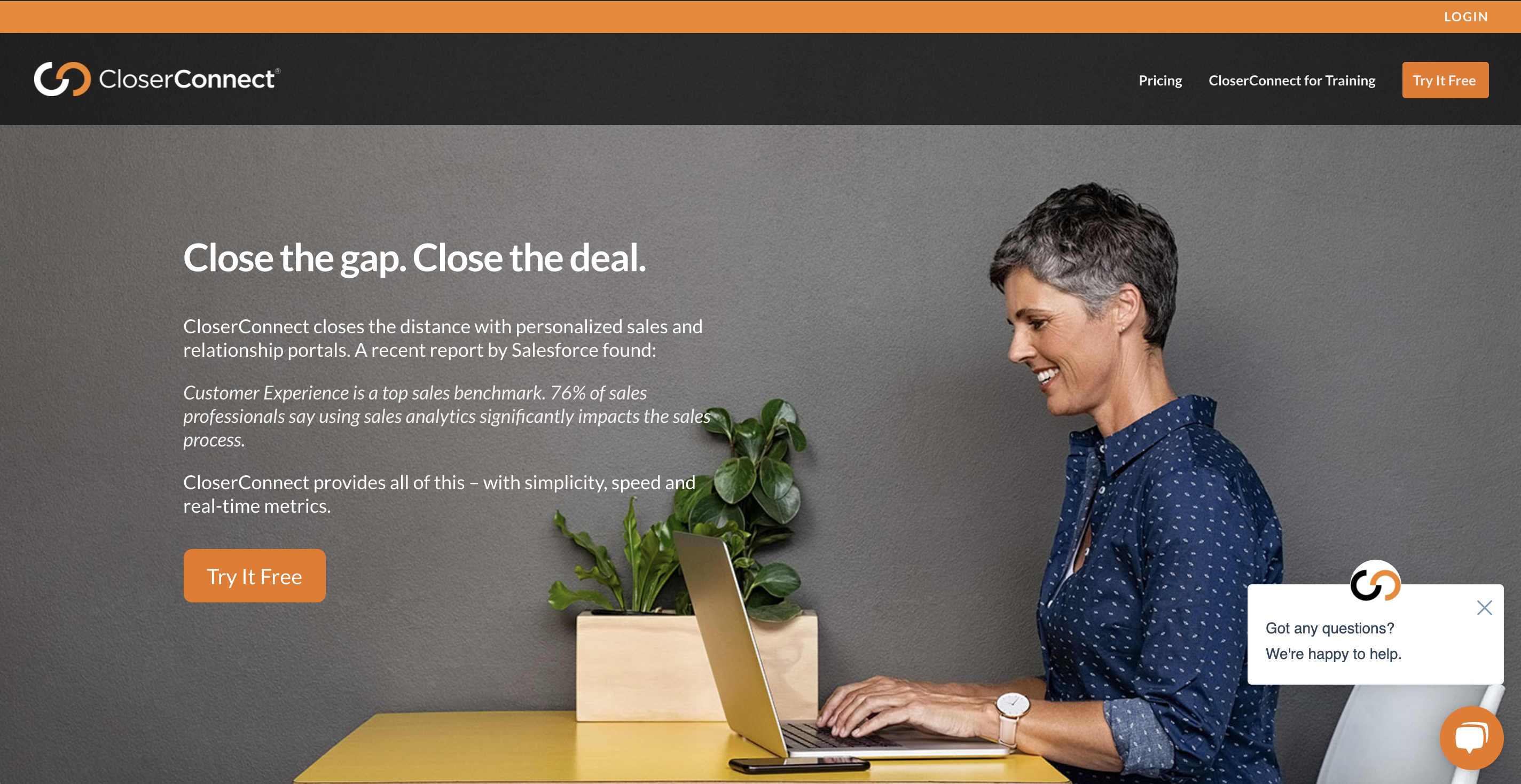

Kaplan is co-founder and CEO of CloserConnect, a sales-enablement SaaS that enables SDRs and AEs to easily create new custom content portals for each of their prospects. Mark is on a personal mission to, as he says, “end the attachment era” and usher in a new prospect-friendly method to provide written and video content, agreements and more via CloserConnect portals.

I asked Mark to explain why sales development managers should take a look at his company, and he offered the following: “The way we sell has changed. Today, selling remotely is the norm. And it will continue to be so going forward. So why are we still connecting with prospects and customers the old way — sending emails with attachments? The next generation of effective sales communications will not include attachments! Attachments cannot be personalized nor updated; you have to send a new attachment. And then a new attachment after that. Large attachments can’t be emailed so you need use a third-party software to send them. It’s inefficient and cumbersome.”

Among the important attributes of a CloserConnect portal is that it can be tailored to match your identity or that of the prospect. You’ll also receive notifications on the consumption of resources in the portal to help gauge prospect interest and shape your follow-up conversations.

Mark and I had a conversation about his business situation, and I offered advice to help him get his arms around the SaaS business model and focus his growth investments. Following is the text of the email I sent as a follow-up so that he’d have all the resources in one place. This text is presented with only slight amendments to improve grammar and readability, add a little more detail where it is helpful or to remove anything too specific. I hope it helps you, too.

Dear Mark,

Really valued the time we had together today. Would like to help as I can and in ways that make sense given where your business is.

For now, you should proceed with free HubSpot marketing and CRM/sales products. Using the chatbot from HubSpot free you should be able to add as much as 30 percent to your conversion rate, assuming a reasonably constructed dialog. Chat is a must as far as I am concerned when every dollar invested in traffic and lead generation counts so much.

HubSpot also has a vibrant partner ecosystem like that of Salesforce and it might make sense to target it - there are thousands of partner agencies like Austin Lawrence Group that could be users of your service, free and paid versions, and they can be easily identified as well (1,926 agencies are in the partner directory in the U.S.). HubSpot partners also are typically open to new SaaS solutions to differentiate themselves. To give you an idea of the ultimate size of the market, there are about 78k users of HubSpot software worldwide, so it's possible to test, iterate and build a business model, especially at the early stage, within this universe before you “go big” and target SFDC.

The SaaS business model resources I recommend you start with are:

OpenView Venture Partners - they do a lot of primary research on early stage SaaS and would be a target for funding for you when you gain a little traction. I'd introduce myself before you expect to be able to pitch. Makes you look smart. I don't have a personal relationship per se with anyone there but am connected to a partner I met in Boston last year; if you like I can try to broker an intro when you feel ready. They call freemium "product led growth."

https://openviewpartners.com/product-led-growth/#.XtGtVRNJGgQ

Price Intelligently - these guys are highly regarded on SaaS pricing and packaging and publish solid research on the space. There are a number of deep dives on their website and the blog also is a great resource. Their analytics are built into a few software packages including Chargify, which you should look into when you grow just a little bit - you are going to need a more flexible and sophisticated subscription billing application than what is offered within Stripe (though they can still be your payment processor and are a good choice).

https://www.priceintelligently.com/

Chargify – SaaS subscription software is essential to enable sophisticated subscription billing. There are others but this one is a reasonable choice for early stage to about $25mm in revenues, when you'll want to consider alternatives. They publish a good amount of research on subscription models / pricing that is a good compliment to what Price Intelligently offers - and the PI software can be accessed from within Chargify. We are actively doing integration work with the Chagify team and can make an intro. S/W starts at $149/mo so you can afford it when you grow just a bit - and pricing / packaging is vitally important to be able to test and improve so you can get the most value out of your web traffic and in-app upsells.

Banks that offer good research

SaaS Capital is a lender that specializes in the SaaS space. When you have a little more revenue and might want capital without dilution it could be a path (would be a good problem to have). They also publish valuable and credible research.

https://www.saas-capital.com/research/

Lastly, Key Bank also publishes SaaS research that may be of value. I've included a link to its 2019 report. You might find a nugget or two here as well.

Let's stay in touch as you ramp up.

My agency works with SaaS CEOs, CMOs and sales leaders to optimize go-to-market strategy through our SaaS360 Business Effectiveness Assessment and Report service. If your business isn't growing as fast as you'd like, or KPIs are under pressure, it's a great way to uncover what's holding you back and provides action plans to enhance outcomes. You can read more about SaaS360 in this blog or book a meeting with me to learn more. I'd be happy to help.